How To Set Up Venmo For Donations

Venmo has been around since 2009 and chop-chop grew popular with younger generations. Over 70 million people (nigh in the United states) utilize Venmo to transport funds to friends and family unit, pay for goods, and make donations to nonprofit organizations. The app processed $230 billion in total payment volume in 2022. Adding Venmo to your nonprofit's donation system tin can aid you reach younger donors that may have seemed inaccessible.

Venmo has been around since 2009 and chop-chop grew popular with younger generations. Over 70 million people (nigh in the United states) utilize Venmo to transport funds to friends and family unit, pay for goods, and make donations to nonprofit organizations. The app processed $230 billion in total payment volume in 2022. Adding Venmo to your nonprofit's donation system tin can aid you reach younger donors that may have seemed inaccessible.

With this article, we'll help you lot empathise –

- How Does Venmo Work?

- Benefits of Using Venmo

- How to Use Venmo to Increase Donations

- Venmo Vs.PayPal

How Does Venmo Work?

Venmo is a digital wallet suitable for individuals and businesses. People can download the Venmo app on their Android or iOS phone, create an account, and link their bank accounts, and credit/debit cards to it to start using the payment service. Users tin can besides put coin in their Venmo account that can exist easily used to make payments at whatsoever point in time. This makes Venmo a more than desirable pick for users in the US.

For nonprofits, one of the all-time features Venmo offers is the advantage of social proof. Venmo users tin can share their payments with their connections on Venmo. The privacy settings tin be adapted on the App – to public, friends, or private. Since younger generations love to share, you lot're most likely to be getting a lot of attention through their donations on Venmo.

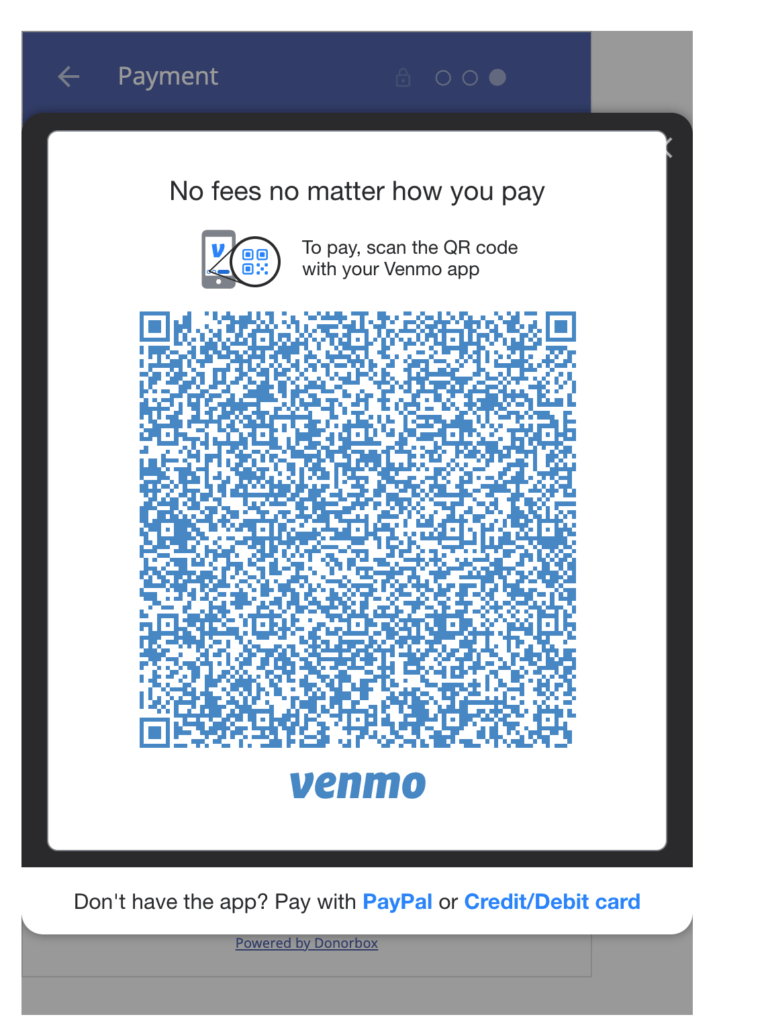

This social-media-style feed also comes with features like emojis and blithe stickers. Most Millennials and Gen Z are used to sharing through cute emojis and stickers. The other of import feature is QR codes. Your donors tin can hands brand a donation by scanning a unique QR code on their mobiles. Easy peasy!

Every bit a nonprofit, you can either ready a business contour on Venmo and share your QR code with donors to help them make a quick donation during events or through your website.

Alternatively, many fundraising platforms offer this donation tool to nonprofits. You can use Donorbox UltraSwift Pay to encourage your donors to pay with Venmo in addition to other pop digital wallet options.

half dozen Benefits of Using Venmo

The Venmo app gives nonprofit organizations an affordable and easy selection to reach younger donors. The average Venmo users are from the age of 25 to 34 years old. And the average transaction amount remains between $65 and $75. As a nonprofit arrangement, you need to tap into this potential to reach out to students and other donor types that prefer giving in minor amounts.

1. Free publicity

As we've already discussed, younger generations find Venmo'due south communication features highly-seasoned when sharing payments with friends. The fact that the app automatically shares transactions on its social-media-style feed means your nonprofit tin benefit from free publicity each time someone makes a donation.

two. Easy to utilize

Younger donors love mobile payment services, especially, digital wallets, and Venmo is quick and easy to use. They can either give via their connected bank accounts or cards or by using their digital wallet money. Scanning QR codes and making a donation is another preferred choice for about donors.

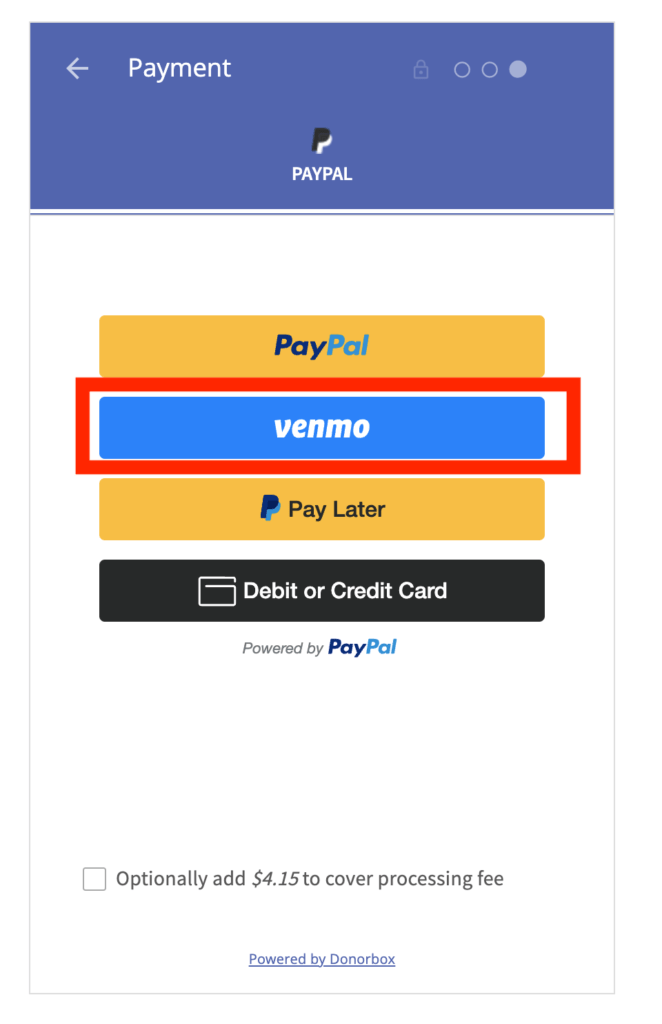

Nonprofit organizations that use PayPal as a payment processor can let donors easily requite via Venmo (through desktop/mobile) in uncomplicated steps using the Donorbox donation form.

3. Affordable for nonprofits

Nonprofit organizations pay a low transaction fee of ane.nine% +$0.x. At that place are no set-up costs or monthly fees. If nonprofits are connecting to Venmo through PayPal Checkout, the processing fee structure will follow that of PayPal. They'll accuse 1.99% + $0.49 for registered nonprofits.

4. Venmo users accept a greater ability to requite

People who use Venmo often keep extra funds in their accounts if they need them. This ways they have access to coin non otherwise accounted for in their budget. Cheers to this, nonprofits accept a way to remove a principal reason people don't donate, which is that they don't have the funds available.

five. Easier to class relationships

Venmo lets people send messages with their donations. They too allow nonprofit organizations to message back and start a conversation with donors when they're open up to the relationship. Once a nonprofit receives a donation, all they have to practise is give thanks the donor immediately, and you're already on the correct rail.

6. Venmo is secure and reliable

Venmo is owned by PayPal. That itself means the parent company will ensure utmost payment security and protection on the App. Moreover, if you're using PayPal Checkout to accept donations via Venmo (on Donorbox), y'all tin rest assured that PayPal'southward secure payment system will take care of everything.

How to Use Venmo to Increase Donations

i. Add Venmo to your donation form

Donorbox makes it easy for nonprofits to take Venmo donations. Since near nonprofits already take PayPal as a payment processor option, the starting time step is already washed. If non, you can quickly enable it by inputting your PayPal-registered email ID and by signing in to PayPal. Afterward that, yous must upgrade to PayPal Checkout on the Donorbox dashboard. Now, you'll exist all set to take donations with Venmo via PayPal Checkout on Donorbox.

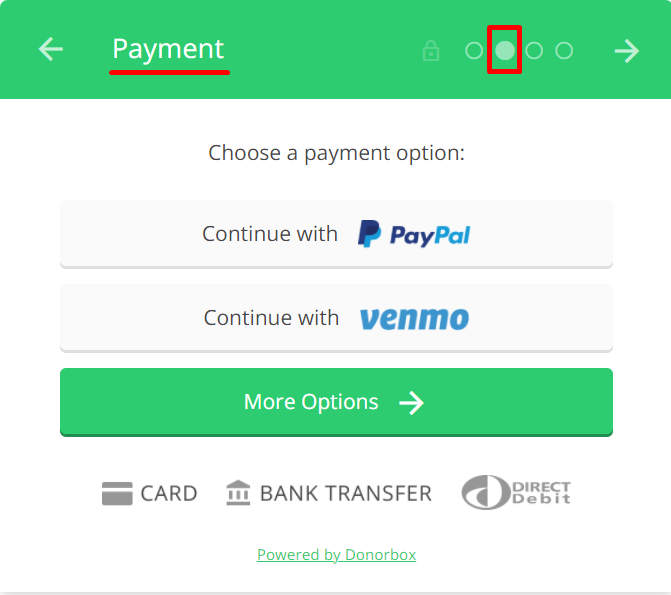

Alternatively, nonprofits tin opt for Donorbox UltraSwift Pay (automatically enabled for all new campaigns on Donorbox) to let their donors pay with super-fast digital wallets including Venmo. It'south highly recommended as this simple and quick donation course makes giving a breeze without your donors having to input their personal details. Hither'due south how information technology looks –

ii. Promote your Venmo QR code

Venmo uses QR codes to make accepting payments easier for businesses. By creating one for each business relationship, they brand it simple for nonprofits to encourage their donors to give easily. Y'all should promote this QR lawmaking beyond all possible channels including emails, social media, website, donation pages, and offline/online events.

If online donors are opening your donation form on the desktop and using PayPal to give via their Venmo account, they'll be shown a QR code to scan from their Venmo app and complete the donation. This mode, y'all're not only limited to mobile devices for Venmo donations.

3. Target young donors

Venmo's social media feed shares where people are sending money. Nonprofits using Venmo should be aware and keep track of this feed. When you see a donation, comment on the feed to bring attention to the gift. Younger donors capeesh the recognition and will be more than interested in giving again in the future.

Some other creative way nonprofits can highlight Venmo donations is by alive-streaming the Venmo feed during a virtual or hybrid issue. This way, yous tin can promote a dissimilar way to give and encourage more donations through social proof.

four. Build relationships

Venmo allows individuals and nonprofits to ship personal letters forth with their gifts. This feature gives nonprofits some other communication tool and opportunity to form a relationship with the donor. When yous receive a donation via Venmo, exist sure to send a quick personal response. Don't forget to make it meaningful or funny with stickers and emojis. Immature people are quick to notice if information technology's but an automated response.

Venmo vs. Paypal

PayPal bought Venmo in 2022, but that doesn't mean the experience is the aforementioned. Both these mobile payment services are like shooting fish in a barrel to set up for nonprofits and donors. It doesn't cost anything to set up an account, but the fees to send and receive donations are different for each.

PayPal is used in more than than 200 countries and with over 25 currencies. Donors can give up to $10,000 each time with a total cap of $threescore,000. PayPal also offers its nonprofit users a discounted processing fee of 1.99% + $0.49 per transaction. Only in well-nigh cases, PayPal lone is not the best option for nonprofits due to a lack of customization, branding, and fundraising opportunities.

On the other hand, Venmo doesn't all the same accept a dedicated nonprofit program. But it tin exist seamlessly integrated with donation forms similar that of Donorbox. Venmo has a much lower giving limit of $299.99. Only Venmo is mostly used for smaller donations, then this limit is mostly non an issue. Also, the transaction fee remains depression at just 1.9% +$0.10.

Ease of employ and sharability are the master reasons people utilize the Venmo app. Most users appreciate that they can transport coin for free equally long as it's coming from their Venmo balance, bank account, or debit card. Venmo is currently only available in the United States.

Final Thoughts

Add Venmo to the fundraising options for your nonprofit organization and watch the magic unfold. Your fundraising platform should have this already added to its donation class.

Explore more than ways of fundraising and engaging with your donors on our nonprofit blog. Subscribe to our newsletter to have insightful tips, resource, and guides delivered to your inbox every calendar month.

Donorbox has a plethora of uncomplicated-to-use features to offering to nonprofits, forth with Venmo donations. Our features range from convenient Recurring Donation Forms and Donation Pages to Crowdfunding, Peer-to-Peer fundraising, Events, Memberships, Text-to-Give, Donor Management, and more.

Nonprofits looking to scale their fundraising efforts should opt for Donorbox Premium – an all-in-1 fundraising solution offer a dedicated business relationship manager, expert fundraising coaching, high-functioning tools, and priority technical support.

Frequently Asked Questions (FAQs)

ane. Why use Venmo for your nonprofit system?

Venmo is an first-class fashion to entreatment to younger donors. The simplicity, fast payments, and shareability make it a pop app that millions of younger people already use.

2. What does it toll nonprofits to use Venmo?

There is no startup fee to employ Venmo. Businesses using it to accept payments take to pay a transaction fee of 1.9% + $0.10. But if you're connecting to Venmo through PayPal Checkout, the charges will be the same every bit PayPal processing fees i.e a one.nine% + $0.49 fee for registered nonprofits.

iii. What does information technology price donors to utilize Venmo?

Venmo doesn't cost donors annihilation if they send coin directly from the Venmo business relationship, depository financial institution business relationship, or debit card. There's a three% standard fee for users making payments with credit cards.

Source: https://donorbox.org/nonprofit-blog/venmo-for-nonprofits

0 Response to "How To Set Up Venmo For Donations"

Post a Comment